By: Sahra Mohamed

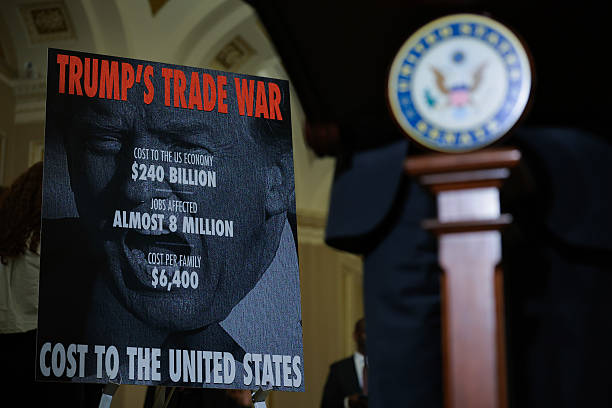

President Donald Trump has escalated global trade tensions with a sweeping set of tariffs. As reported by BBC News, a baseline 10% tariff on all imports to the United States took effect on April 5, impacting goods from countries such as the United Kingdom, Argentina, Australia, Brazil, and Saudi Arabia. On April 9, steeper tariffs were introduced targeting 60 other countries. Cambodian goods now face a 49% tariff, Vietnamese imports 46%, and European Union products are being taxed at 20%. Chinese imports, originally set for a 54% tariff (on top of an existing 20% rate), were instead hit with a massive 104% charge after China refused to go back its own 34% retaliatory tariffs. In response, Beijing announced it would impose an 84% tariff on all U.S. imports starting April 10.

Adding to the economic chaos, Trump’s tariff measures also include plans to eliminate the duty-free exemption on imported goods valued under $800, though this will only be implemented once the U.S. has sufficient personnel to process shipments from all countries. While the White House has described the tariffs as “reciprocal,” aiming to align with the tariffs other countries impose on the U.S., BBC News notes that the new rates are actually based on the U.S.’s trade deficits with those countries, not their existing tariff levels. This means nations like the UK, which imports more from the U.S. than it exports, are still being subjected to the new tariffs. Trump mentioned that over 70 countries have reached out to the U.S. since the tariff announcement to start negotiations. Speaking at the National Republican Congressional Committee event in Washington, D.C., he told the audience, “I’m telling you, these countries are calling us up, kissing my ass. They are dying to make a deal.” The U.S. President mocked world leaders, claiming they are calling to negotiate tariffs as they take effect.

A new report from CNBC, shows how the escalating trade conflict has caused the stock market to drop, especially in sectors that rely on foreign imports. This has raised concerns for everyday Americans, particularly those with 401(k) retirement plans. Experts caution that if the trade tensions continue and inflation rises, it could impact investment growth. Rising borrowing costs and increased production expenses for companies will likely push up everyday costs for consumers. As tariff hikes and retaliations continue to escalate between the U.S., China, and other nations, economists warn that we may be entering a new phase of global economic uncertainty. Ironically, the very consumers the tariffs are meant to protect could end up bearing the brunt of the costs. Trump, in his remarks after his inauguration, famously called tariffs “the most beautiful word” in the dictionary, claiming they would bring jobs back to the U.S. and make the country “rich as hell.” However, as tensions persist, it remains unclear whether this approach will truly benefit those it is intended to help.

Leave a Reply